For @RepMaxineWaters and @FSCDems

Tuesday at 10 am ET,

John J. Ray III, Sam Bankman-Fried @SBF_FTX to testify before our committee investigating the collapse of #FTX

@SBF_FTX

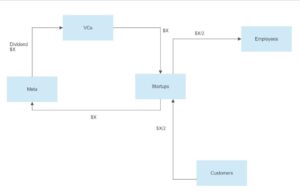

1) The financial circle-jerk

6:26 AM · Aug 14, 2022

https://twitter.com/SBF_FTX/status/1558761957825593345

2) NOT FINANCIAL ADVICE

Much of this will be overly simplistic and missing lots of nuances. Take it all with a grain of salt!

Or many grains of salt. I love salt. You can never have too much salt. (Not medical advice!)

3) In the last year, Meta has made around $100B of revenue.

As Zuck famously reminded us, it comes–mostly–from selling ads.

https://www.youtube.com/watch?v=n2H8wx1aBiQ

4) But to who, exactly, do they sell ads?

Well, a lot of people.

For instance, Uber. Or Sofi, or Affirm, or Robinhood, or Coinbase, or Doordash.

(Or, for that matter, FTX, although not in large size–it’s mostly exploratory/experimental for us.)

MEDIA

5) The flow of funds here is:

a) company P pays $ to Meta

b) Meta runs ads, customer S sees them

c) S buys services from P for $

d) P uses the $ from S to buy more ads; return to (a) above

Ok, cool, so what?

6) Well, a lot of companies are currently making negative money, on net.

Including a lot of companies that advertise on Meta, and Google.

So the $ from (a) — that companies pay to Meta to advertise — are often greater than the $ they get from (d), i.e. customers.

7) If P is net loss-making, where is the money coming from that it’s using to advertise?

8) To make it even weirder: someone once made money by buying *his own pizzas* from Doordash:

A pizzeria owner made money buying his own $24 pizzas from DoorDash for $16

https://www.theverge.com/2020/5/18/21262316/doordash-pizza-profits-venture-capital-the-margins-ranjan-roy

9) Ok, well, so, what’s the *full* flow of funds here?

Well…

a) VCs invest in Meta

b) VCs invest in $ X company P

c) P sends $ X to Meta for advertising

d) Customer S buys services from P, paying back $ X/2

e) P raises $ X/2 more from VCs

f) Go back to step (c)

10) You might think that Meta, and Google, are making their money from customers, or from companies.

And to some extent that’s true!

11) But to some extent they’re making money from VCs, because here’s the *net* flow of funds:

i) VCs: – $ X/2, + stock

ii) Customers: – $ X/2, + some pizza

iii) Companies: – stock, create pizza

iv) Meta: + $ X

12) In other words:

–Customers buy cheap pizza from companies

–VCs send money to Meta

–VCs get equity in companies

13) And what exactly do the companies get out of this?

Well, one of the following, really:

a) marketshare: future profit (???)

b) founders get to sell out in secondaries

c) you get to be ‘a part of the future’

14) But it gets even weirder.

Because who is Meta, exactly?

Well, Zuckerberg, to some extent.

But mostly, it’s similar shareholders to the companies investing in it.

15) And so the flow of funds is, to some extent, really a cycle of funds.

SBF-Flow-of-Funds

photo https://twitter.com/SBF_FTX/status/1558761976830070784/photo/1

16) But how about VCs that *don’t* get large dividends from Meta and Google?

https://twitter.com/SBF_FTX/status/1558761979862519808/photo/1

17) And who exactly are the ultimate investors?

They’re people, investing in stocks.

Also, they’re college endowments, and pension funds.

18) When deployed correctly, modern finance can be breathtaking: seamlessly providing financing to innovative ideas, with the sharpest investors getting paid back a lot in the long term.

When deployed recklessly, it can be breathtaking, I guess, just in a different way.

19) That’s kind of how modern finance works.

It’s also, for what it’s worth, similar to how postmodern finance works:

https://twitter.com/SBF_FTX/status/1558761986451718145/photo/1

@SBF_FTX

Mar 18

1) Between inflation and recession:

Post-Modern Monetary Theory

https://twitter.com/SBF_FTX/status/1504869173733863425

— AND BTW —

Kevin Oleary made $15,000,000 dollars as a paid shill (brand ambassador) of FTX.

I am not scared of investing in entrepreneurs that have had catastrophic failures. Failure is often the best teacher.

Maxine Water’s husband served as an ambassador to the Bahamas during the Clinton administration.

Here’s Maxine Waters blowing a kiss to Sam back in 2021

https://twitter.com/ClownWorld_/status/1593344639154630656

Crypto news site @TheBlock__ has been secretly funded for over a year w money funneled to its CEO LLCs from #SBF’s @AlamedaResearch

—3 loans total:

—$12M & $15M loans went to The Block

—$16M used by CEO to buy real estate in Bahamas

https://www.axios.com/2022/12/09/bankman-fried-funded-crypto-news-site-block

SBF secretly funded crypto news site The Block and its CEO’s Bahamas apartment AXIOS

The Block, a media company that says it covers crypto news independently, has been secretly funded for over a year with money funneled to The Block’s CEO from the disgraced Sam Bankman-Fried’s cryptocurrency trading firm, sources told Axios.

Why it matters: The payments, which employees of The Block were previously unaware of, could undermine the news company’s credibility and cast doubt on its coverage of Bankman-Fried, the now-bankrupt FTX and Alameda Research, Bankman-Fried’s trading firm.

One $16 million batch of funding from Alameda was used in part to finance the purchase of an apartment in the Bahamas for Block CEO Michael McCaffrey, according to sources familiar with the transactions. Driving the news: McCaffrey has resigned as CEO and is leaving the company.

@tier10k

[DB] The Block: CEO Michael McCaffrey Resigned After Failing to Disclose a Series of Loans From SBF’s Alameda Research. He Was the Only Person With Knowledge of the Funding at the Company.

Larry Cermak is @lawmaster

1. @lawmaster is customer of FTX

2. FTX uses customer deposits to fund things

3. FTX funds The Block

4. @lawmaster receives his salary with said funding There’s a lot of rekt folks but imagine waking up to the notion that you have been paying your own salary”

Larry Cermak on Twitter:

“Because I’m incredibly autistic, I exported all the Alameda investments (more than 470!) from the FT piece. The total amount invested is roughly $5.3 billion.

The largest investments are:

1) Genesis Digital Assets

2) Anthropic

3) Digital Assets DA AG

4) K5

5) IEX

Alameda investments here

delian @zebulgar

I went to MIT & studied CS, one year under SBF

When he graduated in 2014, the place where all the top tier engineers went was Palantir

If you couldn’t pass that interview, then it was Dropbox/FB etc

And the third-tier was quant/finance, ie Jane Street

SBF was tier-3 bad eng

anyways… only a tier-3 idiot would suggest fixing the first ponzi scheme…

with a bigger, better ponzi scheme

“I did not knowingly commingle funds” (SBF, nov 30th at NY Times DealBook) is something I do not believe in. Either you have infrastructures and procedures to handle customer funds separately, or you don’t. If you don’t, then you are knowingly commingling funds, it’s that simple. @MagicalTux

WARNNG NUDE ART

Bro you literally are the penis in a massive financial circle jerk.