©1998*Educational CyberPlayGround®

https://edu-cyberpg.com

ECP Blog NetHappenings

* https://cyberplayground.org

CyberPlayGround₿ ∞/21M 109K Tweets

Daily * https://twitter.com/cyberplayground

©1993 https://k12playground.com

© https://RichAsHell.com

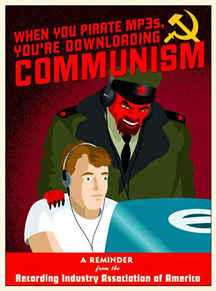

Its Security Awareness Month. And with that comes scary imagery of blurred exploit code superimposed on a faceless “hacker” in a black hoodie. The cybersecurity industry thrives on stereotypes and FUD that vilify the hacker identity. Solutions aren’t sold without a problem.

The cybersecurity industry thrives on stereotypes and FUD that vilify the hacker identity. Solutions aren’t sold without a problem.

In partnership with @FBI, @CISAgov issued an #ElectionSecurity Public Service Announcement: Malicious Cyber Activity Against Election Infrastructure Unlikely to Disrupt or Prevent Voting. Full text here

Saudi wants Republicans to Win

Senator Dick Durbin @SenatorDurbin

From unanswered questions about 9/11 & the murder of Jamal Khashoggi, to conspiring w/ Putin to punish the US w/ higher oil prices, the royal Saudi family has never been a trustworthy ally of our nation. It’s time for our foreign policy to imagine a world without their alliance.

YO GARLAND, AMERICA WANTS SECURITY

If you are tired of Democrats being soft on crime, Garland can arrest Trump Now.

Republicans support the most traitorous, criminal president in American History, while claiming that Democrats are being soft on crime. Garland is a pussy. Is there any sexual act or crime so heinous that it would disqualify a Republican from being nominated for office?

I’d rather have a President who drops the occasional F bomb than one who incites insurrection and steals classified nuclear secrets.

Jeff Tiedrich @itsJeffTiedrich

the “fuck your feelings” crowd is melting straight the fuck down and throwing a massive fucking shit-fit because Joe Biden dropped a fucking f-bomb and holy fucking shit, I guess my fucking question is what the fuck is wrong with these shameless fucking fucks.

Sorry, fossil bros… it’s just cheaper. Solar Is Now 33% Cheaper Than Gas Power in US, Guggenheim Says

Ronna McDaniel says the RNC is going to sue Google since millions of their fundraising emails keep going into users’ spam boxes.

RNC complains the spam they send out,… gets filtered into recipients’ spam folders. HA isn’t that just to fucking bad!!!

So white people will reject their own benefits if they think Black people will benefit more. Jesus. “A group in Wisconsin claims President Biden’s plan to cancel up to $20,000 in student loan debt violates federal law by intentionally seeking to narrow the racial wealth gap and help Black borrowers.”

The actual WI group that sued

It’s The children of the #HomesteadAct. THE epitome of America’s welfare babies.

Dan Froomkin/PressWatchers.org @froomkin

The elite media covers bigots and fascists as trendsetters.

Journalism in service of the billionaire class

Washington Post media reporter Sarah Ellison profiled the new owner of Politico this week, raising a number of disturbing questions. The new owner is Mathias Döpfner, the right-wing billionaire CEO of international publishing giant Axel Springer. His company bought Politico for a billion dollars last year.

#Micron to invest up to $100 bln in semiconductor factory in New York | Reuters

world’s largest #semiconductor fabrication facility, is expected to create nearly 50,000 jobs in #NewYork

Russia has killed tens of thousands of Ukrainian civilians. Hundreds of cities and villages were bombed. Occupied part of the territory of Ukraine. And now, when their army starts to suffer defeats, they start talking about “negotiations”.

Russia has killed tens of thousands of Ukrainian civilians. Hundreds of cities and villages were bombed. Occupied part of the territory of Ukraine. And now, when their army starts to suffer defeats, they start talking about “negotiations”.

Uber’s former head of security Joe Sullivan found guilty of obstructing an investigation by the Federal Trade Commission into Uber’s security practices and hiding a 2016 data breach from authorities. @CourthouseNews

Funders of Musk’s Proposed Twitter Buyout Have Bailed on Him

Funders of Musk’s Proposed Twitter Buyout Have Bailed on Him

Just a day after Elon Musk announced his intention to complete his purchase of Twitter, a group that intended to provide $1 billion earlier this year to fund his proposed buyout has reportedly stepped away from the deal.

YO Gary where were you when this was happening?

This guy committed a crime Do Kwon’s passport has been officially voided by South Korea — and he has 14 days to surrender it to the authorities and where the hell is Gary Gensler? pulling idiot kardassian bullshit stunts for his kiss ass stupid ego.

SOMEONE JUST FILLED TO LAUNCH AN ETF THAT INVERSES JIM CRAMER

IT WILL TRADE UNDER THE TICKER $SJIM

IT WILL INCLUDE AROUND 20 – 25 NAMES JIM CRAMER RECOMMENDS ON HIS SHOW AND INVERSE THEM

THIS ETF WLL GO LIVE DEC 19TH

THIS ETF IS BY @TuttleCapital

THE SAME GUY WHO MADE THE LEGENDARY $SARK ( WHICH SHORTS $ARKK)

We all should call Cramer during his show and ask him “Should I buy $SJIM”.

BITCOIN:

BITCOIN:

We are trying to separate money & the state with #Bitcoin. We want a neutral, censorship-resistant, & scarce money with a predictable issuance & known supply. #BTC is the only shot we have at this. Otherwise, we will be vassals to the central banks forever.

There are over 62,500,000 millionaires in the world, and only 21,000,000 bitcoin. You don’t need to be a millionaire to buy a #Bitcoin you can buy 5 dollars a week.

SPECIAL ANNOUNCEMENT 📢📢📢

For a long time, #Bitcoin has been underrepresented in academic and policy circles. This is one of the challenges of a truly decentralized project.

This gap has produced a large body of research that ranges from questionable to entirely FALSE. Some of the worst, most widely-discredited research ever produced about bitcoin helped form the basis for the White House’s recent policy ideas.

Swan thinks it’s time to do something about this!

That’s why we are donating to the Bitcoin Policy Institute @btcpolicyorg, a think tank advancing a vision of an America strengthened by open monetary networks. btcpolicy.org

Inflation is not natural.

Inflation is not normal.

Inflation is the direct and intended result of central bank money manipulation. And so are recessions.

Russia has killed tens of thousands of Ukrainian civilians. Hundreds of cities and villages were bombed. Occupied part of the territory of Ukraine. And now, when their army starts to suffer defeats, they start talking about “negotiations”.

Russia has killed tens of thousands of Ukrainian civilians. Hundreds of cities and villages were bombed. Occupied part of the territory of Ukraine. And now, when their army starts to suffer defeats, they start talking about “negotiations”. Funders of Musk’s Proposed Twitter Buyout Have Bailed on Him

Funders of Musk’s Proposed Twitter Buyout Have Bailed on Him BITCOIN:

BITCOIN: